SNF Billing & EOBs: How to Read Your Nursing Home Statement (Atlanta Guide)

Originally published: September 2025 | Reviewed by Sadie Mays

Originally published: September 2025 | Reviewed by Sadie Mays

Getting a nursing home bill can feel overwhelming, especially when you’re already dealing with the stress of caring for a loved one.

The Explanation of Benefits (EOB) shows what you owe but not what you’ve already paid, so your actual bill should never be higher than the Patient Balance listed on your EOB.

Many families in Atlanta struggle to make sense of these statements and end up paying the wrong amounts or missing important billing errors.

Skilled nursing facilities use a tangled billing system that involves Medicare, Medicaid, and private insurance.

SNF billing is a complex process that involves multiple steps and various forms, depending on the type of coverage.

If you can figure out how to read these documents, you will save hundreds or even thousands of dollars in wrong charges.

Learning to match your nursing home bills with your EOBs is a skill every family needs.

This guide will walk you through each part of your statement, show you how to spot common errors, and give you the tools to protect yourself from billing mistakes that, honestly, happen way too often in the nursing home industry.

Nursing home bills often combine various rate structures, insurance programs, and medical billing codes, which can contribute to confusion.

The words on these statements rarely match how families actually talk about care.

Daily rates form the basis of nursing home billing, but they vary significantly depending on the care level and room type.

Private rooms typically cost $150-$ 300 more per day than shared rooms.

The base daily rate covers basic services like meals, housekeeping, and general nursing supervision.

However, families often assume that this includes every bit of care their loved one receives—it doesn’t.

Ancillary charges show up as separate line items and might include:

These charges add up fast. If your family member receives physical therapy three times a week, plus wound care, you could see an additional $800-$ 1,200 a month on top of the base rate.

The billing system separates services that families consider a single package. When a nurse helps with medication during therapy, you get billed separately for both.

Multiple insurance programs overlap, creating complex rules that often confuse individuals reviewing their bills.

Medicare Part A covers skilled nursing facility stays for up to 100 days after a qualifying hospital stay.

Days 1-20 get full Medicare coverage. Days 21-100 require a daily copayment of $204 in 2025.

After day 100, Medicare Part A stops covering skilled nursing care entirely.

Medicare Part B handles outpatient services within the nursing home:

| Service Type | Coverage | Patient Responsibility |

| Doctor visits | 80% after deductible | 20% coinsurance |

| Physical therapy | 80% after deductible | 20% coinsurance |

| Medical equipment | 80% of the approved amount | 20% coinsurance |

Medicaid becomes the primary payer for long-term custodial care once Medicare benefits are exhausted.

But Medicaid pays much less than private insurance does.

Private insurance policies are widely available. Some help with nursing home costs, while others don’t cover long-term care at all.

Bills often show charges from multiple payers for the same time period. One statement might include Medicare payments, Medicaid reimbursements, and private pay amounts all at once.

Medical billing uses procedure codes that don’t align with how families describe their care.

Families see “ambulation training” on bills, but they’re just thinking, “helping mom walk.”

Revenue codes make it even trickier:

Even a simple shower might show up as “personal care services” or “activities of daily living assistance.” Clinical terms hide what actually happened.

Therapy services use time-based billing and split single sessions into multiple charges. A 45-minute physical therapy session might appear as three separate 15-minute units.

Bundled services versus itemized services often create confusion. Some facilities include wound care in their daily rates, while others bill it separately as “treatment room procedures.”

The same care activity can get different billing codes depending on who provides it. If a nurse aide assists with walking, it is considered “personal care.” If a physical therapist does it, it’s “therapeutic exercise.”

An EOB breaks down what insurance paid for nursing home services and what the patient owes.

These documents contain specific claim details, adjustment codes, and payment calculations that determine final patient responsibility amounts.

If you’re ready to get started, call us now!

The Claim Details section lists each service provided, including dates, procedure codes, and billed amounts.

It shows the original charges submitted by the nursing home for room and board, therapy services, medications, and medical supplies.

Service codes appear as five-digit numbers that flag specific treatments.

Room charges typically utilize revenue codes in the 0100-0200 range, while therapy services employ codes in the 0400-0500 range.

The adjustments section shows reductions from billed amounts. Common adjustments include contractual discounts, Medicare allowable amounts, and non-covered services.

These adjustments reduce the total before insurance pays its share.

Patient responsibility sits at the bottom and includes deductibles, coinsurance, and non-covered charges.

This section shows the exact dollar amount the patient or family needs to pay after insurance has done its thing.

EOBs use a bunch of abbreviations that patients should know:

Reason codes explain payment decisions. Code 1 indicates deductible, code 2 represents coinsurance, and code 3 denotes copayment.

Remark codes give more info. Code M80 means services not covered by Medicare, while N435 means missing or invalid documentation.

These codes help families see why certain amounts got paid, reduced, or denied by insurance.

Medicare EOBs adhere to a standardized format and employ specific terminology.

They display Medicare-approved amounts, which are typically lower than the amounts billed by the nursing home.

Medicare pays 80% of approved amounts after deductibles, leaving patients with 20% coinsurance.

Medicare EOBs include benefit period info. Each period allows 100 days of skilled nursing coverage, with copayments starting on day 21.

Private insurance EOBs vary by company, but they usually display the same basic information.

They might have different copayments, annual deductibles, and coverage limits than Medicare.

Private insurance often negotiates different rates with nursing homes. Their EOBs display contracted amounts instead of Medicare-approved rates, which can result in different out-of-pocket costs for you.

Dual coverage situations create multiple EOBs when patients have both Medicare and supplemental insurance. This requires coordination of benefits between payers, which can become complicated quickly.

Matching skilled nursing facility bills with explanation of benefits involves verifying three key elements: service dates and codes must match exactly, insurance adjustments should align with the EOB, and any duplicate or unauthorized charges must be identified and removed.

Start by making sure every service date on the SNF bill matches the date on the EOB.

Each line should show the same dates for the same procedures.

Procedure codes need to match between documents. The SNF bill lists CPT codes for physical therapy, occupational therapy, and nursing services.

Those same codes should appear on the EOB, along with matching quantities.

Key items to check:

Facilities sometimes submit amended claims, which leads to discrepancies. If dates or codes don’t line up, ask the facility for clarification.

Insurance adjustments on the EOB should bring down the original charges to the contracted rates.

The SNF bill needs to show these same adjustments as credits or reductions.

Medicare Part A coverage usually pays a set daily rate for SNF stays. The EOB shows this rate, and the facility bill should match it.

Common adjustment types:

If you have secondary insurance, double-check those adjustments too. When Medicare is primary and you have a supplemental plan as secondary, both EOBs must line up with the final SNF bill.

Duplicate charges occur when facilities bill for the same service more than once on the same date. You’ll want to compare each line on the SNF bill with the EOB to identify any repeats.

Unapproved services show up as denied claims on the EOB. These should not be included on the patient’s bill unless the facility provided proper advance notice.

Red flags to watch for:

Check any charges that go above what’s approved on the EOB. Facilities aren’t allowed to bill patients for more than the insurance-approved rates, unless it’s for non-covered luxury items that the patient has specifically requested.

If inspection reports and billing statements leave you uncertain, Sadie G. Mays Skilled Nursing team provides transparent care and communication. Gain clarity and confidence—contact us today to schedule a care consultation.

If you’re ready to get started, call us now!

Nursing home billing mistakes take a real bite out of families’ wallets every year. The most common ones?

Therapy billing, room charges, and Medicare benefit calculations.

Therapy billing becomes complicated when facilities charge for more minutes than patients actually received. Medicare expects exact records for physical, occupational, and speech therapy sessions.

Common therapy billing mistakes:

Facilities need to record the exact start and stop times for every session. Therapists should sign off on all records and clearly document their actions.

Medicare Part A covers therapy services under certain Resource Utilization Groups (RUGs). These categories determine daily rates based on the number of therapy minutes per week.

Request copies of therapy logs to ensure billed minutes align with the actual services provided.

Double-billing for room and board happens when facilities charge for days the patient wasn’t even there. This often comes up during hospital stays or transfers.

Medicare says nursing homes can’t charge room fees when patients are in the hospital for more than a day. The facility needs to give credit for those days back.

Room/board error warning signs:

Keep a list of all hospital admissions and compare dates to the nursing home bills. The facility should provide you with their bed-hold policy in writing, so you know when they’ll charge during absences.

Medicare Part A gives 100 benefit days per period for skilled nursing care. The first 20 days are fully covered, and days 21-100 require a daily copay from patients.

Sometimes, facilities miscount the benefit day and cause patients to pay too soon. They might also forget to reset benefit periods after a qualifying hospital stay.

Benefit period basics:

If a patient returns to the hospital for three days and then resumes skilled care, the Medicare coverage clock restarts. Double-check that your benefit day count matches what’s on your Medicare Summary Notice.

Good documentation makes it significantly easier to resolve billing disputes. Keep detailed notes on services, dates, and any talks you have with staff.

What to keep track of:

If you spot any errors, please contact the billing department immediately. Ask for a written explanation for any disputed charges within 30 days.

If the facility won’t fix obvious mistakes, file a complaint with your state Medicare office. Medicare has set timelines for investigating and resolving these disputes.

Keep your paperwork organized for each billing period. You may notice patterns if errors continue to occur.

If you’re in Atlanta, you’ve got some solid programs to help with SNF billing disputes and Medicare coverage questions.

These local groups offer free assistance with understanding EOBs, appealing denied claims, and resolving billing errors.

Georgia SHIP offers free, unbiased guidance to Medicare beneficiaries and their families regarding health insurance options. They help people untangle confusing Medicare nursing home bills.

SHIP counselors can explain Medicare Part A coverage for SNF stays. They’ll review your EOBs, flag billing errors, and help with appeals if a claim was denied by mistake.

Services include:

You can reach SHIP through your local Area Agency on Aging. They do phone and in-person appointments at community centers around Atlanta.

The program is available free of charge to all Georgia counties. Counselors keep up with the latest Medicare rules and billing practices.

The Atlanta Legal Aid Society helps low-income seniors with nursing home billing disputes. Their Elder Law Project focuses on Medicare and Medicaid issues for older adults.

Legal aid attorneys help challenge incorrect SNF bills and represent clients at Medicare appeal hearings. They also assist with Medicaid applications for nursing home coverage.

Who qualifies:

The Elder Law Project takes on cases like billing fraud, wrongful discharge, and Medicare coverage denials. Attorneys work directly with nursing homes to resolve these disputes.

Clients get representation for free. The program prioritizes urgent cases, especially those involving financial hardship or a risk to essential services.

The Centers for Medicare & Medicaid Services runs a regional office in Atlanta that oversees nursing home billing and compliance. This office investigates complaints about improper SNF billing.

The regional office also provides Healthcare IT support and monitors facilities for billing accuracy. They’ll step in if a nursing home submits fraudulent claims or charges patients incorrectly.

You can file complaints about billing issues straight to the Atlanta CMS office. They review Medicare claims data to spot bad billing patterns at specific facilities.

Common complaints:

CMS investigators can audit nursing home records and even penalize facilities that keep breaking Medicare billing rules.

If you’re ready to get started, call us now!

Georgia’s Long-Term Care Ombudsman program looks into complaints about nursing home billing. Ombudsmen advocate for residents’ rights and assist in resolving disputes with facilities.

The program addresses complaints regarding billing transparency, surprise charges, and financial exploitation. Ombudsmen actually visit nursing homes to address billing concerns raised by residents or their families.

Local ombudsmen cover different Atlanta metro regions. They stay in touch with nursing facilities to monitor billing and resident care.

What they do:

The ombudsman program operates separately from state agencies. This keeps their investigations independent and free from conflicts of interest.

You can contact ombudsmen anonymously. The program protects you from any retaliation by facility staff or management.

Nursing home residents and families have the right to challenge wrong bills through Medicare’s five-level appeal process and Georgia’s private insurance protections.

Professional advocates can help you navigate complex billing disputes and ensure you receive proper documentation.

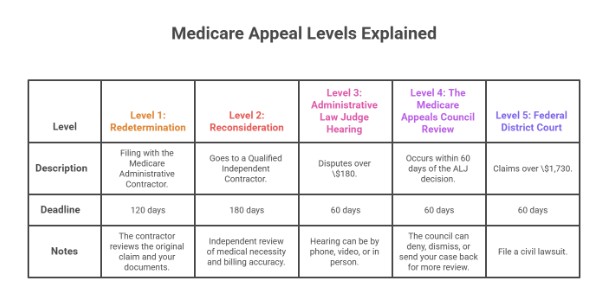

Medicare has a five-level appeal process for fighting nursing home charges. Each step comes with its own deadlines and paperwork.

Level 1: Redetermination means filing with the Medicare Administrative Contractor within 120 days of the first decision. The contractor reviews the original claim and your documents.

Level 2: Reconsideration goes to a Qualified Independent Contractor within 180 days if Level 1 doesn’t work out. This step gives you an independent review of medical necessity and billing accuracy.

Level 3: Administrative Law Judge Hearing is for disputes over $180 and must be filed within 60 days. The hearing can be by phone, video, or in person.

Level 4: The next step is the Medicare Appeals Council Review, which occurs within 60 days of the ALJ decision. The council can deny, dismiss, or send your case back for more review.

Level 5: Federal District Court is the final step for claims over $1,730. You’ll need to file a civil lawsuit within 60 days.

Georgians with private insurance have special protections under state and federal law. Insurance companies must spell out appeal procedures in their plan documents.

Internal Appeals must be filed within 180 days of the denial notice. Plans have 15 days for pre-service appeals and 30 days for post-service appeals to be addressed.

External Reviews kick in after you finish all internal appeals. Georgia utilizes independent review organizations to resolve disputes over medical necessity.

Expedited Appeals are for urgent cases where a delay could really hurt your health. You’ll get a decision within 72 hours for internal appeals and 5 days for external reviews.

Insurance plans aren’t allowed to retaliate if you file an appeal. They must maintain your coverage during the appeal process if you’re receiving ongoing treatment.

You have the right to receive detailed billing statements. An itemized bill lists every charge, the service date, and the corresponding billing code.

How to ask: Send a written request to the nursing home’s billing department. Include the patient’s name, service dates, and account number.

The facility has to provide itemized bills within 30 days. These should break out room charges, meds, therapy sessions, and supplies.

What to check: Look for duplicate charges, services you never got, wrong billing codes, and charges for stuff you brought from home. Compare bills to medical records and care plans.

Check for charges that continue after discharge or transfer. Make sure Medicare deductibles and coinsurance match what’s on your official Medicare statements.

Sometimes, you just need backup. Professional advocates step in to help you untangle tricky billing disputes and insurance appeals.

They are familiar with all the medical billing codes and the intricacies of insurance rules. It’s their job to make sense of the chaos.

Billing Advocates typically charge by the hour, ranging from $75 to $150, or they may work on a contingency basis.

They’ll review your bills, identify mistakes, and communicate with providers and insurers on your behalf. It’s honestly a relief to have someone in your corner.

Healthcare Attorneys come in when things get dire—big money or possible legal violations.

They can take your case to court or represent you in administrative hearings. Sometimes, it’s the only way to get results.

Select advocates who are familiar with nursing home billing. Don’t be shy—ask about their track record and how they charge before you commit to anything.

Choosing the right facility means more than paperwork. Sadie G. Mays Rehabilitation and Respite Care services combine licensed compliance with compassionate support. Take the next step—contact us now to schedule your visit.

If you’re ready to get started, call us now!

What is a facility license in healthcare?

A facility license is a state authorization proving that a nursing home, hospital, or clinic meets regulatory standards for safety, staffing, and care. Without it, a facility cannot legally operate. Families should confirm a license before choosing long-term or skilled care services.

How can I verify a nursing home’s license in Georgia?

To verify a nursing home license in Georgia, use the Georgia HFRD Facility Locator. Search by facility name or city to confirm active status and see inspection results. This ensures the facility is legally approved and compliant with state safety and care regulations.

What is an EOB in skilled nursing facility (SNF) billing?

An Explanation of Benefits (EOB) is an insurance statement summarizing what Medicare, Medicaid, or private insurance covered. It’s not a bill but shows billed services, amounts paid, adjustments, and what the patient may still owe, helping families understand nursing home charges clearly.

How often are nursing facilities inspected in Georgia?

Georgia nursing facilities are typically inspected every 9 to 15 months, depending on their compliance history and the frequency of complaint reports. Additional inspections may be conducted if issues arise. These visits assess staffing, safety, and the quality of resident care, and the results are publicly posted for family review.

What are common nursing home billing errors?

Common nursing home billing errors include duplicate therapy charges, misapplied Medicare days, and non-covered services billed incorrectly. Families should compare facility bills with insurance EOBs, request itemized statements, and question discrepancies to avoid overpayment or uncovered costs being wrongly shifted to residents.

How do I compare the inspection histories of multiple nursing homes?

You can compare multiple nursing homes using CMS Care Compare, which provides star ratings, health inspection outcomes, staffing levels, and quality measures. By entering ZIP codes or facility names, families can compare the performance of different facilities side by side, ensuring a transparent comparison before selecting long-term care.

What should I do if a facility has repeated violations?

If a facility shows repeated violations, request the corrective action plan directly from administrators and confirm implementation. Families may also file complaints with the Georgia HFRD or the Long-Term Care Ombudsman, or explore alternative facilities to ensure their loved ones receive safe and reliable care.